Real Cryptocurrency has been dead for a long time

Original Article Title: the real crypto died long ago

Original Article Author: hitesh.eth

Original Article Translator: DeepFlow Tech

Since the birth of cryptocurrency, it has always been based on altruism. Early adopters of any cryptocurrency-based products were not motivated by pursuit of wealth. In fact, they were willing to contribute resources to early encrypted networks like BitTorrent to help a large community.

Back in those days, when OTT (over-the-top media services) were not yet popular, watching a high-quality movie online was a challenging task, almost a global issue. We had to wait for several months until it aired on television to see those movies that weren't feasible to watch at the theater every weekend.

The film culture has been continuously growing and expanding, which I believe is the only culture that consistently attracts more and more people. Those drawn to the film culture often stay in it for a long time, and cryptocurrency played a catalytic role in this process. It made the global community more inclusive through the internet, transforming the film culture into a more diverse and welcoming space.

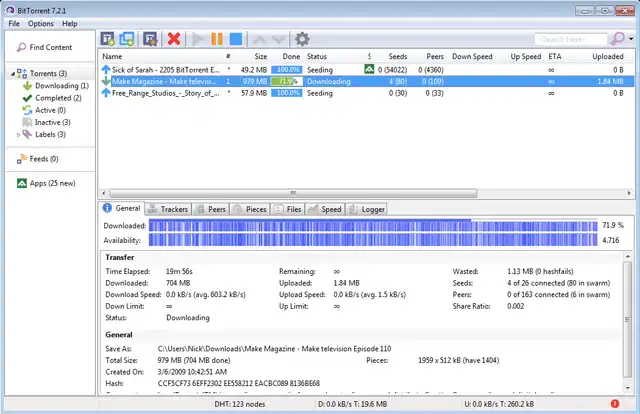

Many individuals shared movie files through their computer systems, utilizing seeds and peers for sharing, and we downloaded them from their systems peer-to-peer (p2p). It was like magic. It was free, entirely driven by a shared love for movies.

This resistance against centralized systems and processes, empowering people by returning power to them, is the core spirit of those who consciously or unconsciously participated in early encrypted products.

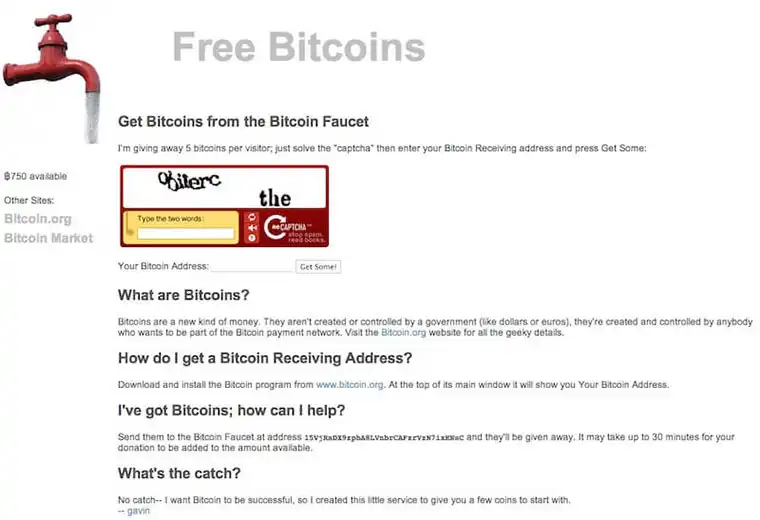

Subsequently, Bitcoin emerged, marking a significant milestone in the crypto space. In Bitcoin's early days, those who joined the network were not concerned about its price. They focused on building the network, educating more people, and driving early adoption. They even altruistically gifted Bitcoin through forums, offline meetings, events, and mailing lists.

During 2009 and 2010, thousands of Bitcoins were given away for free, when Bitcoin actually had no market value. However, with the emergence of exchanges, Bitcoin became tradable and gradually acquired market value. This changed everything. The spirit of altruism took a back seat as fear and greed quietly crept in, gradually polluting the network's consciousness.

Events such as Mt. Gox, Bitconnect, OneCoin, and others have become typical examples. These malicious actors have squeezed millions of bitcoins from ordinary people who held dreams and hopes. We always thought of ourselves as early adopters of the game. In reality, we were not, my brother.

In fact, we arrived too late, even later than those who, in a remote corner, driving a taxi with a big smile on their faces, lost 10 bitcoins due to the Bitconnect scam. These people are the real early adopters. They believed in Bitcoin, but never truly understood its significance.

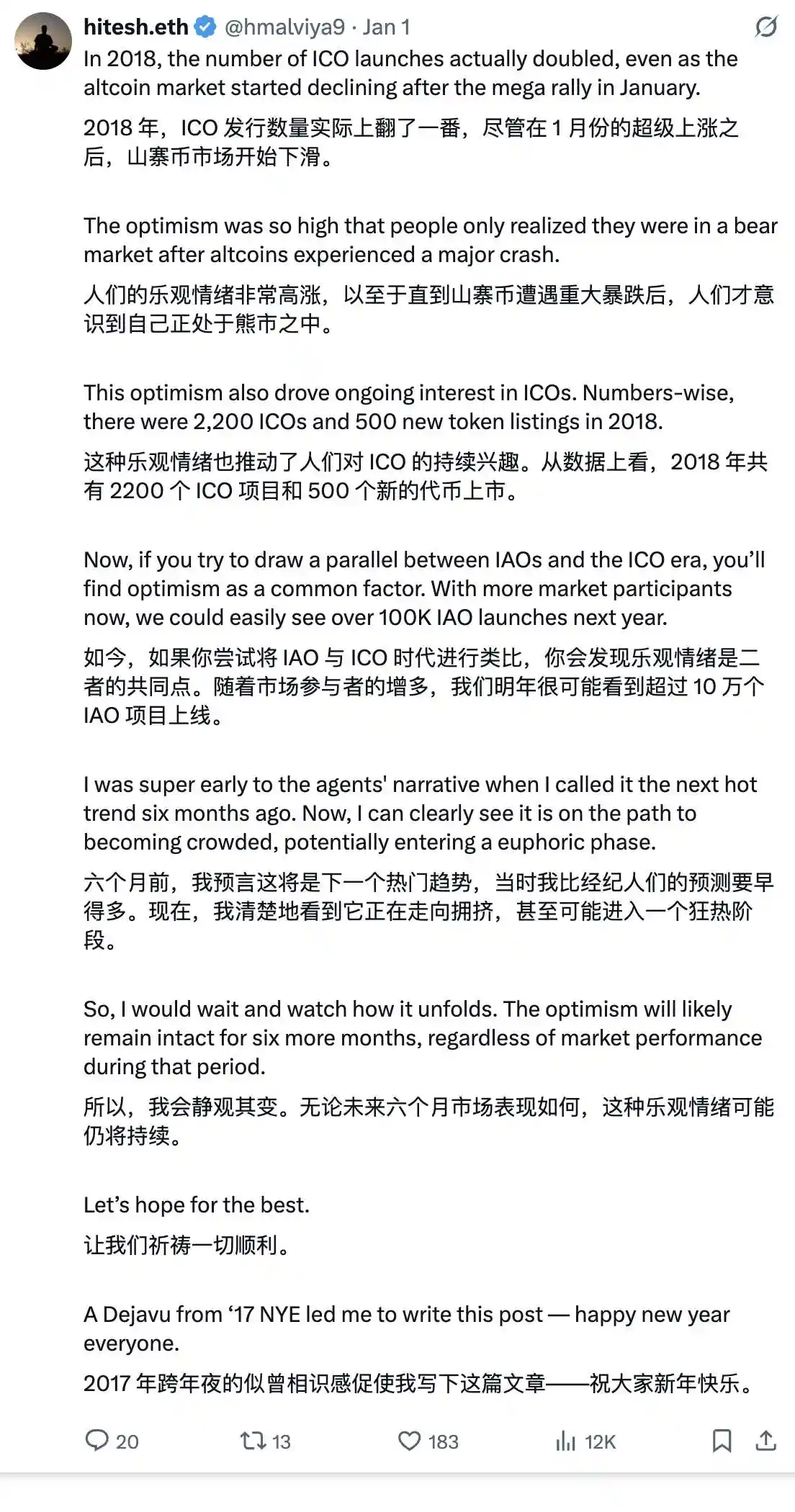

Perhaps, everything changed after money became intertwined with cryptocurrency. Those who decided to build the crypto market after 2012 made "profiting from information asymmetry" their new agenda. They achieved great success in the market, especially in 2017, when hundreds of tokens were traded on a few exchanges, giving rise to the ICO (Initial Coin Offering) craze. Over the next 12 months, more than 500 tokens entered the market through ICOs. Projects raised billions of dollars through ICOs. However, most tokens never got proper listing, and almost all ICO tokens eventually disappeared within three years.

But when these projects were hot, people thought they would change the world. Everyone believed in these ideas, without realizing that the infrastructure was far from ready. Some genuinely concerned individuals kept warning others, but no one was willing to listen. All they saw in their eyes were others making money, success stories shared online, and that was enough to make them believe that cryptocurrency would change their lives. They believed and thus lost. And the bad actors succeeded once again. Some even successfully disguised themselves as "good guys" and are still operating at higher levels today.

The New Face of Crypto

Crypto tokens have become commitment data strings with limited supply, controlled by project teams. The project teams strategically release the token supply slowly into the market, using part of the distribution to create artificial demand, then designing incentive mechanisms to attract early adopters, associating their identity and reputation with the tokens.

These incentives are not just economic but also psychological triggers aimed at triggering belief, tribalism, and Fear Of Missing Out (FOMO). The real product is not the token but an illusion. The narrative built around these data strings is not only false but also carefully emotionally manipulated. The target has always been those in the survival cycle, the reactive mind, those millions of people seeking meaning and craving faith.

Once you tap into this kind of thinking, you don't even need evidence, just a story, a symbol of what seems like a "last chance." The human mind, conditioned by decades of scarcity, shame, or missed opportunities, will eagerly grab onto these narratives with both hands. And the individuals behind these data strings know this all too well. What they are selling is not a product, but hope—a hope cloaked in digital, trend, and community terms. They skillfully exploit information asymmetry because hope is the easiest drug to sell and the hardest to quit.

What we are witnessing is not something new; it's just faster now. The concentration of wealth has always relied on this asymmetry. A few know the rules of the game, while the majority cling tightly to their dreams. But in the world of tokens, the speed at which beliefs spread far exceeds the speed of reflection. Victims don't even have time to pause and think because the next promise has already emerged—shiny, trendy, full of potential, and just credible enough to seem like the hope of redemption.

The Extractor's Truth

We have reached a point where we feel deceived but cannot accept this fact. For new market participants who have just entered, hope is still visible; but for veterans who have experienced two to three market cycles, they can't even digest the current market structure. It's something they can't truly accept. They can't keep up with the changing narrative, can't track the rapid operation of catalysts, and can't act swiftly because they are still stuck in the market concepts they once thought were simpler.

However, upon deeper reflection, the market has never been about being "simple" or "complex"; it's all about scale. In the past, an "extractor" faced a hundred thousand users, but now, an "extractor" only needs to face a hundred users.

The probability of being extracted has become extremely high. Even in the extractor's world, there is competition, so they cannot focus their attention on one thing for too long to avoid exposure. They constantly throw out new narratives to excite participants.

People hover between winning and losing, some stay, some leave, but extraction never stops; instead, it continues to scale up. Even within the extraction cycle, there will always be a window for you to exit with gains, depending on your discipline, risk management, and the lessons learned from the past. Some clever individuals exit at the right time to continuously profit, while others fall into "exit liquidity." This cycle will continue because the extractors know they have only just scratched the surface of human greed.

As mainstream adoption increases, more people will be trapped in it. And when this happens, the government will intervene in the name of regulation to "save" us, ultimately diverting the extracted funds into their own hands through taxation.

Reflection

When you realize all of this and start to ponder, comparing it to the original intention of altruism, you may find yourself in tears, seeing everything we have done to cryptocurrency.

Once, it was such a pure, liberating, and hopeful thing, showing us the possibility of an alternative system.

It was supposed to give power back to us.

And now, we seem to have power, but it is a power lost.

We followed the ideals of altruism, yet we handed over our peace of mind and money to the market, while some scammer lurks in the corner, laughing at our foolishness.

A dream turned into an illusion, the illusion then transformed into exploitation, and perhaps this is the true story of cryptocurrency.

You may also like

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Russia Caps Crypto Investments at $4,000 Annually for Non-Qualified Investors – Will Others Follow Suit?

Key Takeaways Russia’s proposal sets a $4,000 annual investment limit for non-qualified crypto investors, sparking discussions on regulatory…

Japan’s Metaplanet Announces $137 Million Capital Raise Via Third-Party Allotment

Key Takeaways Japanese firm Metaplanet Inc. has strategized a $137 million capital raising through the third-party allotment of…

Crypto Price Prediction for January 28 – XRP, Solana, Bitcoin

Key Takeaways Bitcoin price recently hit $90,000 but struggled to maintain this peak. XRP and Solana are following…

Sygnum Bank Secures Over 750 BTC for Bitcoin Yield Fund’s Growth

Key Takeaways: Sygnum Bank has raised over 750 BTC in the initial phase of the Starboard Sygnum BTC…

Asia Market Open: Bitcoin Holds Steady Near $88K Amidst Asia’s Tech Slowdown and Gold Surge

Key Takeaways Bitcoin remains stable at nearly $88,000 as Asian tech markets show signs of cooling. Global markets…

Dogecoin Price Prediction: DOGE Founder Reveals True Cause of Crypto Market Downturn

Key Takeaways: The recent downturn in the cryptocurrency market, including Dogecoin, is attributed to shifting investor behavior rather…

US Senators Criticize DOJ Over Crypto Crime Unit Closure Amid Financial Conflict Concerns

Key Takeaways: Six US senators have criticized Deputy Attorney General Todd Blanche for shutting down the DOJ’s crypto…

Why Is Crypto Down Today? – January 29, 2026

Key Takeaways The crypto market has fallen by 1.7% over the past 24 hours, with significant declines in…

Bitcoin Retreats as Hawkish Fed and Outflows Pressure Market: Analyst

Key Takeaways: Bitcoin’s value dipped below the $89,000 mark due to restrictive financial conditions and growing geopolitical stress.…

Strive Retires Majority of Debt and Expands Bitcoin Holdings Following Preferred Stock Offering

Key Takeaways: Strive successfully retired 92% of debt inherited from acquiring Semler Scientific, amid a significant preferred stock…

Ethereum Price Prediction: Wall Street Firm Begins to Buy and Lock ETH – Is This Brave or Insane?

Key Takeaways BitMine’s significant investment in Ethereum by securing 4.2 million ETH and staking 2.2 million ETH showcases…

XRP Price Prediction: Price Looks Stagnant – But This Key Signal Just Flashed Green After Months

Key Takeaways Recent indicators suggest a potential bullish trend for XRP, indicating a possible price surge. Traders have…

Bitcoin Is Bouncing – But These 3 Metrics Decide If the Bull Market Is Returning

Key Takeaways Bitcoin’s recent climb towards the high-$90,000 and low-$80,000 ranges signals a partial recovery from significant sell-offs.…

Top Cryptocurrencies to Watch This January: XRP, Cardano, PEPE

Key Takeaways XRP seeks to capitalize on recent ETF approvals to potentially reach $5 in Q1. Cardano aims…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Russia Caps Crypto Investments at $4,000 Annually for Non-Qualified Investors – Will Others Follow Suit?

Key Takeaways Russia’s proposal sets a $4,000 annual investment limit for non-qualified crypto investors, sparking discussions on regulatory…

Japan’s Metaplanet Announces $137 Million Capital Raise Via Third-Party Allotment

Key Takeaways Japanese firm Metaplanet Inc. has strategized a $137 million capital raising through the third-party allotment of…